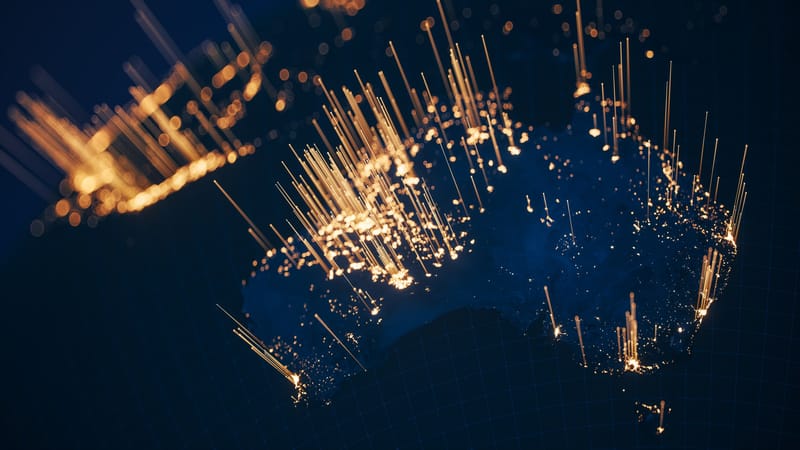

Australia’s nickel industry has been granted access to billions of dollars in federal funding as well as relief from royalty payments after a collapse in the global price of nickel that threatens thousands of jobs.

On Thursday, BHP wrote down the value of its West Australian nickel division Nickel West to zero, and said it was considering placing the entire division into a “period of care and maintenance”.

Nickel is a metal crucial for the production of stainless steel, alloys, electroplating, and the batteries used in electric vehicles.

The global price has dived from a high of US$50,000 in 2022 to just US$16,400 per tonne on Monday in response to a huge increase in supply from Indonesia, much of it from Chinese-owned and operated mines.

On Monday, ahead of this week’s cabinet meeting in Perth, Prime Minister Anthony Albanese said Indonesia had increased its share of the global nickel market by more than 10 times.

Last Friday, his government added nickel to the official Critical Minerals List, giving it access to grants under the A$4 billion Critical Minerals Facility.

And then, on Saturday, the West Australian premier granted miners a temporary 50% rebate on royalties for the next 18 months whenever prices are below $US20,000 per tonne.

China is the largest processor

Lithium, cobalt, nickel and graphite are needed for batteries, and were touted by federal Treasurer Jim Chalmers as essential for powering the clean-energy technologies of the future.

Australia and Indonesia hold the world’s largest reserves of nickel, each with about 21 million tonnes.

But China is by far the largest customer, accounting for 35% of the nickel processed worldwide, plus about another 15% it processes in Indonesia.

China also accounts for about 80% of the rare earth mineral processed worldwide, 90% of the lithium, 70% of the gallium, and the 70% of germanium.

Its incredibly low cost of processing and competitive labour market gives it an almost unassailable advantage, turning suppliers into price takers rather than price-makers.

China helped fund the oversupply

So, what went wrong for Australia? To help keep prices low, China invested in mines in Indonesia, hugely increasing their output.

Australia is attempting to establish alternative processing chains, entering into critical minerals partnerships with India, Japan, Korea, the United States, and the United Kingdom.

But such attempts run the risk of strategic responses in the form of export bans on processed commodities (China has previously imposed bans on the export of gallium, germanium and rare earths), and moves to create oversupplies.

Australia is a leading producer of critical minerals, supplying all 10 of the elements needed for lithium-ion batteries, and has the advantage of better environmental, social, and governance (ESG) standards that make it an attractive destination for investment.

But it lacks the capacity to refine all of its own production, meaning it has to dispose of many of the critical minerals it extracts as byproducts.

China’s stranglehold will be hard to escape

Until Australia can find a way to break free of the market stranglehold of our biggest customer, those investments will remain at risk.

On Monday, Albanese said he was working on a larger response that would ensure Australia had an “ongoing industry in nickel”, which would be one of the resources of the 21st century.

One such effective response would be the creation of a large processing facility to service multiple mines, selling Australian-sourced and processed critical minerals that adhere to higher ESG standards compared to those sourced and processed elsewhere.

The Prime Minister said the decision wouldn’t be quick. He didn’t want a response that lasted “a day or two”.

This article originally appeared on The Conversation.