December has finally arrived and for many this means the beginning of Christmas festivities – dusting off and decorating the Christmas tree, hanging the stockings and lights, and writing your gift list and checking it twice.

It seems Australians are starting to feel festive, too, with the Westpac-Melbourne Institute Consumer Sentiment Index surging 12.8% to 103.8 in November from 92.1 in October.

Notably, November marks the first “net positive” read on consumer sentiment since February 2022, with an index result above 100 meaning that optimists outnumber pessimists.

Indeed, excluding the COVID disruptions in 2020 and 2021, this is the most positive result in seven years.

Last month, Monash Business School’s Australian Consumer and Retail Studies (ACRS) revealed that Australian gift-givers are starting their Christmas shopping earlier this year, with almost half (47%) shopping one to three months in advance (up from 40%), aligning with key retail sales events such as Black Friday.

Additionally, almost half of all sales event shoppers (43%) planned to shop during sales to purchase gifts in advance.

But now that Black Friday is behind us and Christmas is within sight, how are Australians feeling as we approach Christmas, what festivities will they partake in, and what plans do they have around gift-giving?

The annual Christmas and Seasonal Retail Trends Report further unwraps this year’s seasonal retail trends, including who for, what, and where Australians are buying this holiday season.

Feeling the Christmas spirit

Our research reveals 81% of Australians plan to participate in Christmas festivities this holiday season.

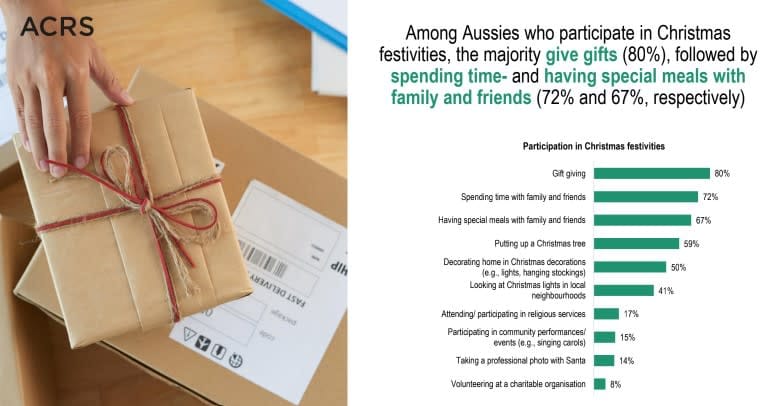

Among those who participate in Christmas festivities, the majority participate in activities connecting them with family and friends (gift-giving, 80%; spending time with family and friends, 72%; having special meals with family and friends, 67%), while about half participate in decorating and related activities (putting up a Christmas tree, 59%; decorating home in Christmas decorations – for example, lights, hanging stockings – 50%; looking at Christmas lights in local neighbourhoods, 41%).

A few participate in activities connecting them with their communities (attending/participating in religious services, 17%; participating in community performances/events, such as singing carols, 15%; volunteering at a charitable organisation, 8%).

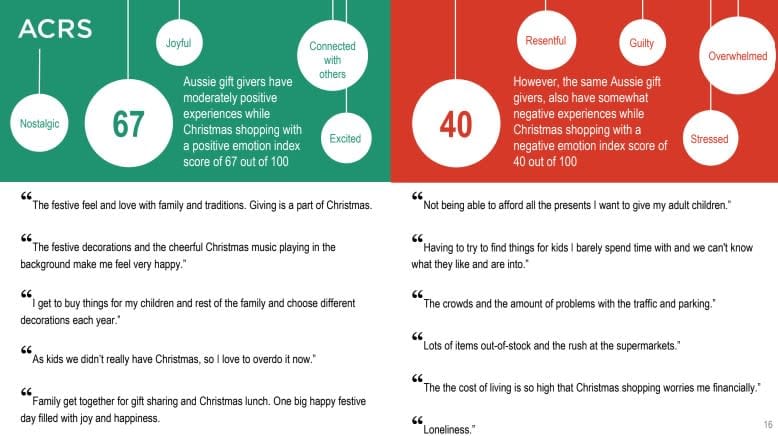

Christmas spirit among Australians who participate in Christmas festivities is moderately high with an index score of 67 out of 100. Further, gift-givers have moderately positive experiences while Christmas shopping, with a positive emotion index score of 67 out of 100.

Gift-givers frequently mention that they enjoy Christmas shopping because it’s a time they spend thinking about or being with their family and friends, they can buy and give gifts to the ones they love – particularly to children – and the festive decorations and cheerful Christmas music makes them feel happy.

However, Australian gift-givers also have somewhat negative experiences while Christmas shopping, with a negative emotion index score of 40 out of 100.

Gift-givers frequently mention that they dislike Christmas shopping due to experiencing financial pressures, the increase in crowds and traffic in the parking area, issues with stock levels, and sometimes feeling lonely and disconnected.

Making a list and checking it twice

The vast majority of Australian gift-givers were planning ahead to avoid purchasing impulsively, with 94% employing various strategies. Almost two-thirds of gift-givers (60%) make a list of people they want to buy Christmas gifts for, while half make a budget (50%) and about half keep a list of items they want to purchase (51%) and research where they can purchase Christmas gifts (49%).

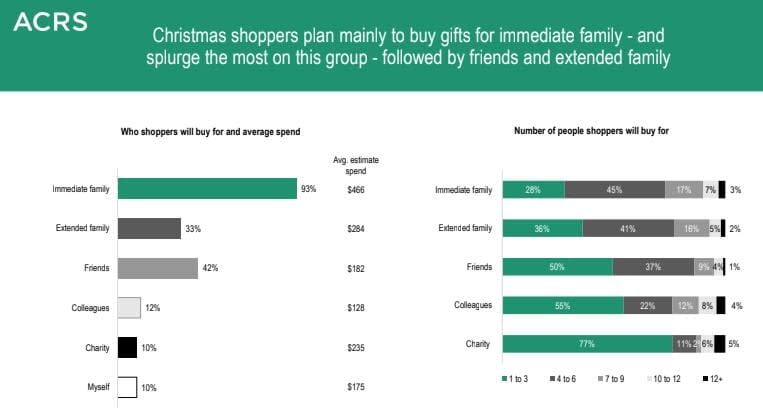

The main beneficiaries of Christmas gift-giving are our nearest and dearest. Christmas shoppers plan to buy the most for immediate family (93%) and to spend most on this group (average spend $466).

Many gift-givers will also buy for extended family (33%; average spend $284) and friends (42%; average spend $182).

While only a small number of gift-givers plan to donate to charity (10%), the average spend for this group was considerable at $235, the third-highest amount behind only immediate and extended family, but above friends, colleagues (10%; average spend $128), and oneself (10%; average spend $175).

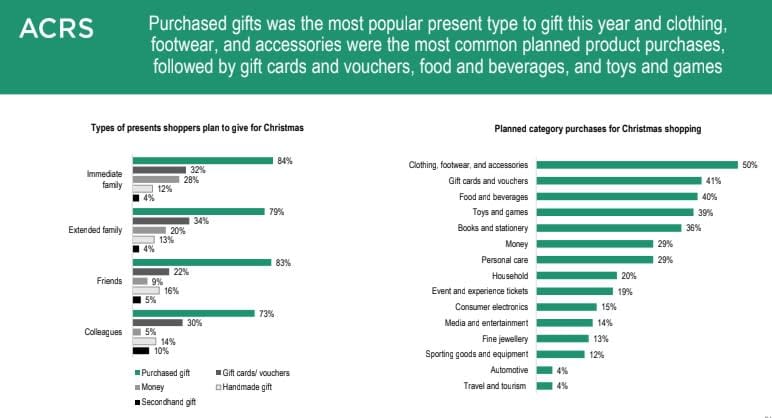

Purchased gifts are by far the most popular present type shoppers were planning to give this year (between 73% and 84% across all gift-receiver groups). Gift cards/vouchers are also a popular choice across all groups receiving gifts (between 22% and 34%), while money is also popular for immediate and extended family (28% and 20%, respectively), but less so for friends and colleagues (9% and 5%, respectively).

Some gift-givers will give handmade gifts (between 12% and 16% across all gift-receiver groups) and a few will give second-hand gifts (between 4% and 10% across all gift receiver groups).

What and where we’re buying this Christmas

Half of Australian gift-givers (50%) plan to purchase clothing, footwear and accessories as part of their Christmas shopping. Other popular products purchased for Christmas this year include gift cards and vouchers (41%), food and beverages (40%), toys and games (39%), books and stationery (36%), and personal care items (29%).

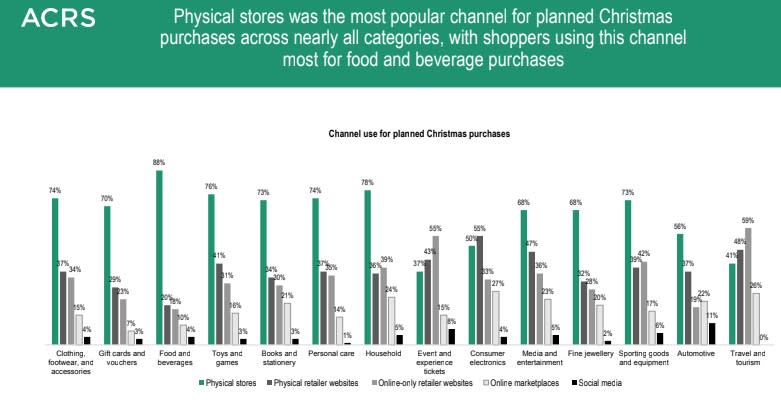

Physical stores remain the most popular channel for Christmas purchases in 2025, with 86% of Australian shoppers planning to visit stores to do their Christmas shopping. This is true across most product categories, especially for all the aforementioned popular Christmas gift categories, with 70% or more shoppers planning to make these purchases at bricks-and-mortar stores.

While physical stores continue to be the most popular purchase channel, the ACRS Retail Monitor recently revealed online shopping had returned to pandemic levels (dipping from 84% in 2021 to 74% in 2022 and steadily climbing back to 82% in 2025).

Further, there was a growing preference for both physical and online shopping across most product categories, as physical and online stores close the gap on highly important purchasing factors such as customer service, payment methods, and delivery and return options.

Our Christmas shopping also reflects the popularity of online shopping this year, with 49% of Christmas shoppers planning to purchase through physical retailer websites (such as Myer) and 45% planning to make Christmas purchases through online-only retailer websites (such as The ICONIC).

Online channels were also more popular than brick-and-mortar stores for event and experience tickets, consumer electronics, and travel and tourism purchases this Christmas.

While the rush of Black Friday is over for the year, retailers and Australian shoppers will continue to navigate the chaos of the silly season in the lead up to Christmas.

Wishing you all a very Merry Christmas and happy holidays in 2025.

Note about the research: Data was collected from n=1014 randomly selected adult Australian shoppers in October 2025.