Christmas is right around the corner, and Australian shoppers are looking to capitalise on upcoming retail sales events to start ticking off their Christmas shopping lists.

Monash Business School’s Australian Consumer and Retail Studies (ACRS) annual seasonal retail research report unwraps this year’s seasonal retail trends as we approach key sales events, including Black Friday, Cyber Monday and Boxing Day.

As cost-of-living pressures continue to loom over households, retail sales events offer a welcome reprieve in the lead-up to Christmas.

Our latest research reveals almost two-thirds of Australian shoppers report that price discounts (for example, “20% off”) are highly important to their purchase decisions (64%), and approximately nine in 10 wait for a sale or promotion in at least one product category before making a purchase (89%; notably, only 11% of Aussies don’t wait for sales or promotions).

Hear those sale bells jingling

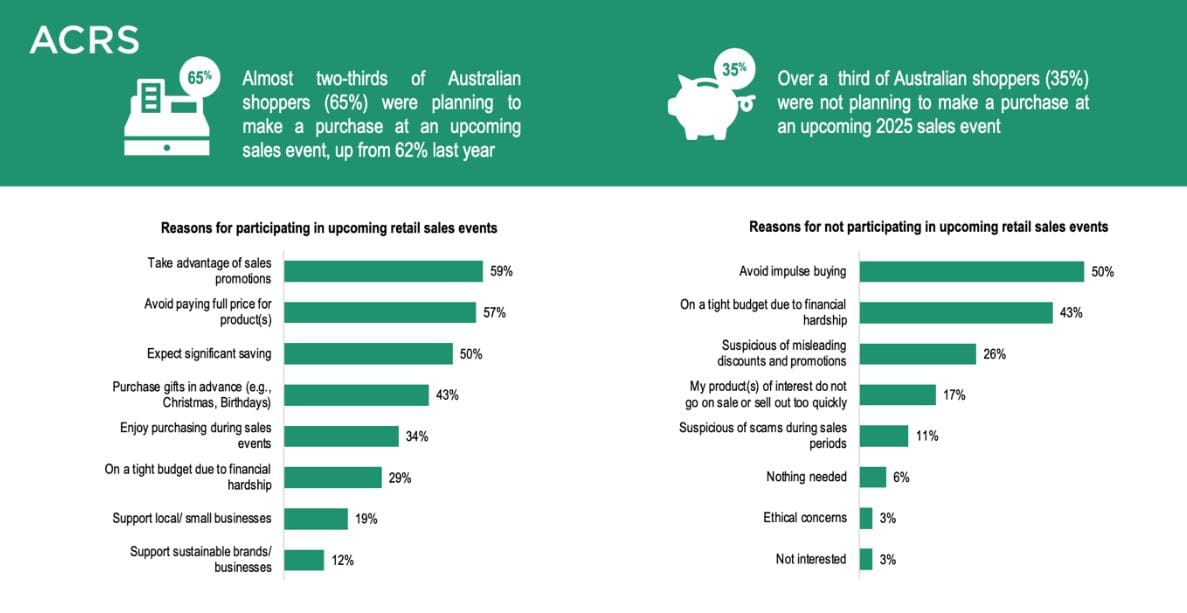

Close to two-thirds of Australian shoppers (65%) are planning to make a purchase at end-of-year sales events across November and December.

We asked shoppers their main reasons for shopping during sales events and found half or more are looking to make big savings (Take advantage of sales promotions, 59%; Avoid paying full price, 57%; Expect significant savings, 50%), while nearly half are purchasing gifts in the lead-up to Christmas (Purchase gifts in advance, 43%) and close to a third are on a tight budget (On a tight budget due to financial hardship, 29%).

However, not all Aussies will be partaking in retail sales. More than a third of shoppers aren’t planning to make a purchase at an upcoming retail sales event (35%), with half of these shoppers looking to avoid impulse-buying (50%) and nearly half on a tight budget due to financial hardship (43%).

Additionally, some shoppers express concerns regarding sales events, with more than a quarter suspicious of misleading discounts and promotions (26%) and a few suspicious of scams during sales periods (11%).

These findings also reflect when shoppers are planning to start their Christmas purchasing this year, and reasons why some are starting their shopping earlier.

Historically, nearly half of Australian shoppers begin their Christmas shopping less than a month prior to Christmas (between 45% and 46% each year from 2022 to 2024), while more than a third begin their Christmas shopping between one and three months in advance (between 37% and 40% each year from 2022 to 2024).

However, this year many are starting their Christmas shopping earlier, with almost half shopping one to three months in advance (47%), aligning with key retail sales events such as Black Friday and Cyber Monday.

Further, those who start their Christmas shopping earlier this year primarily do so because they have more time (68%), plan to buy during promotion periods and/or sales events (44%), and for budgeting purposes (38%).

Savvy sales shoppers

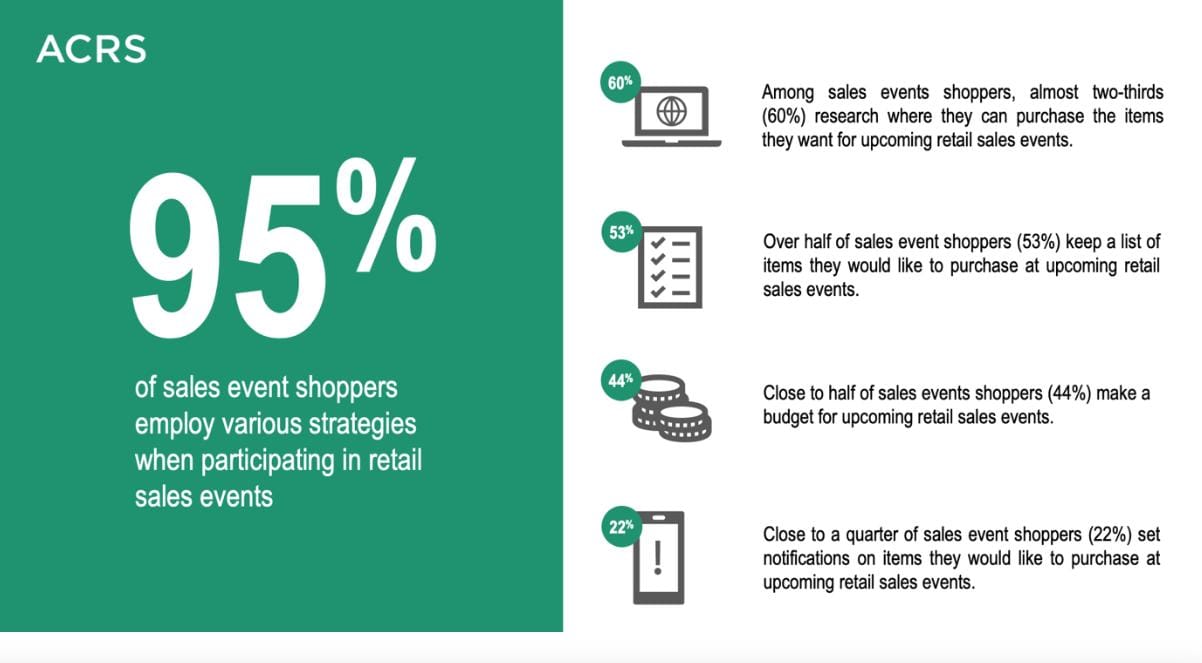

Even among shoppers who plan to make a purchase at end-of-year sales events, the vast majority are planning ahead to fight the urge to purchase impulsively, with 95% employing various strategies when participating in retail sales events.

Almost two-thirds of these shoppers research where they can purchase the items they want (60%), more than half keep a list of items they would like to purchase (53%), close to half make a budget (44%), and nearly a quarter actively set notifications on items they’d like to purchase (22%).

Fashion retailers continue to benefit most, with almost two-thirds of sales events shoppers planning to purchase clothing (64%), footwear, and accessories at an upcoming sales event, followed by more than a third of shoppers who plan to buy consumer electronics (38%), and nearly a third who plan to buy household goods (32%) and personal care items (31%). Almost a quarter plan to purchase toys and games (24%), food and beverages (24%), and books and stationery (23%).

Retailers will need to be able to accommodate a variety of payment methods to make the point-of-sale process as seamless as possible during peak retail periods. Cashless is king, as two-thirds of sales events shoppers plan to pay using debit cards (66%), and nearly half plan to use credit cards (46%).

However, more than a quarter of shoppers still plan to use cash for some purchases (27%). Additionally, close to a quarter plan to pay for their purchases with “buy now, pay later” (24%), a smaller proportion of shoppers compared with last year (30%).

Black Friday reigns

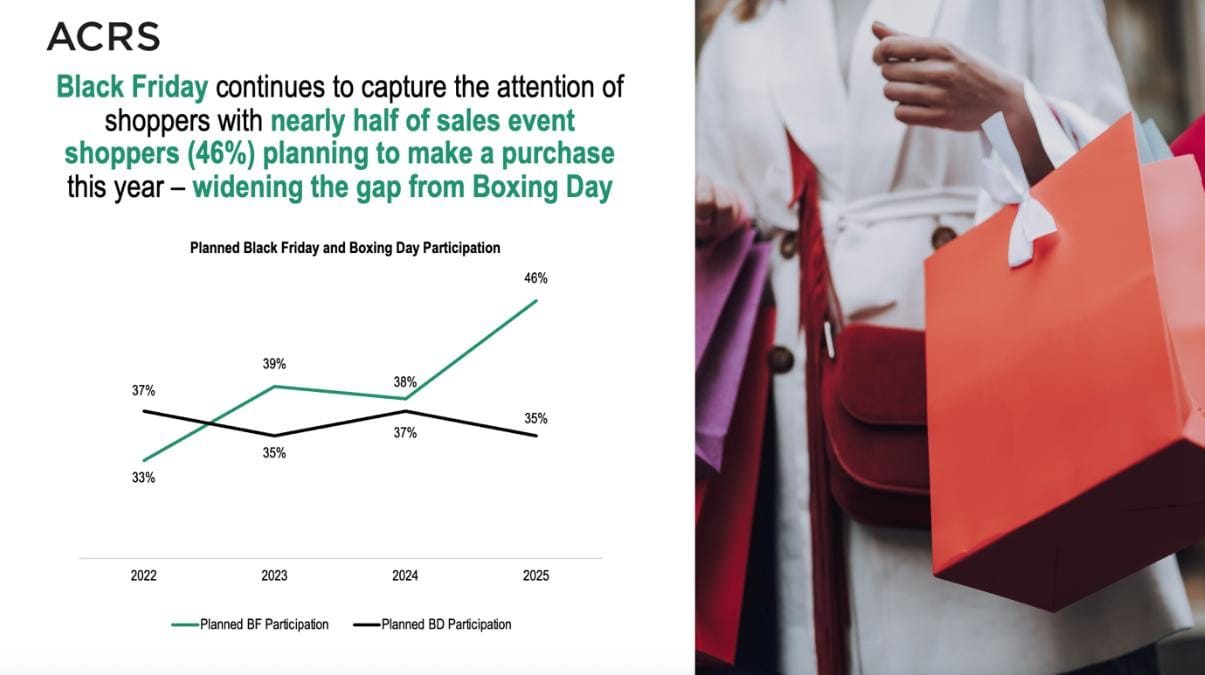

Despite its overseas origins and having only entered the Australian market in the 2010s, Black Friday has become a mainstay sales event in Australia, and arguably the biggest sales event of the year.

Since tracking end-of-year sales events, our research has shown steady growth of Australian shoppers’ planned participation in Black Friday sales. This year, nearly half of sales events shoppers plan to purchase from Black Friday sales (46%), an eight percentage points increase year-on-year (38% in 2024), and a 13 percentage points increase since tracking end-of-year sales events began in 2022 (33% in 2022).

Comparatively, just over a third of sales events shoppers plan to purchase from Boxing Day sales this year (35%), which has been relatively stable since tracking of end-of-year sales events began (between 35% and 37% each year from 2022 to 2025).

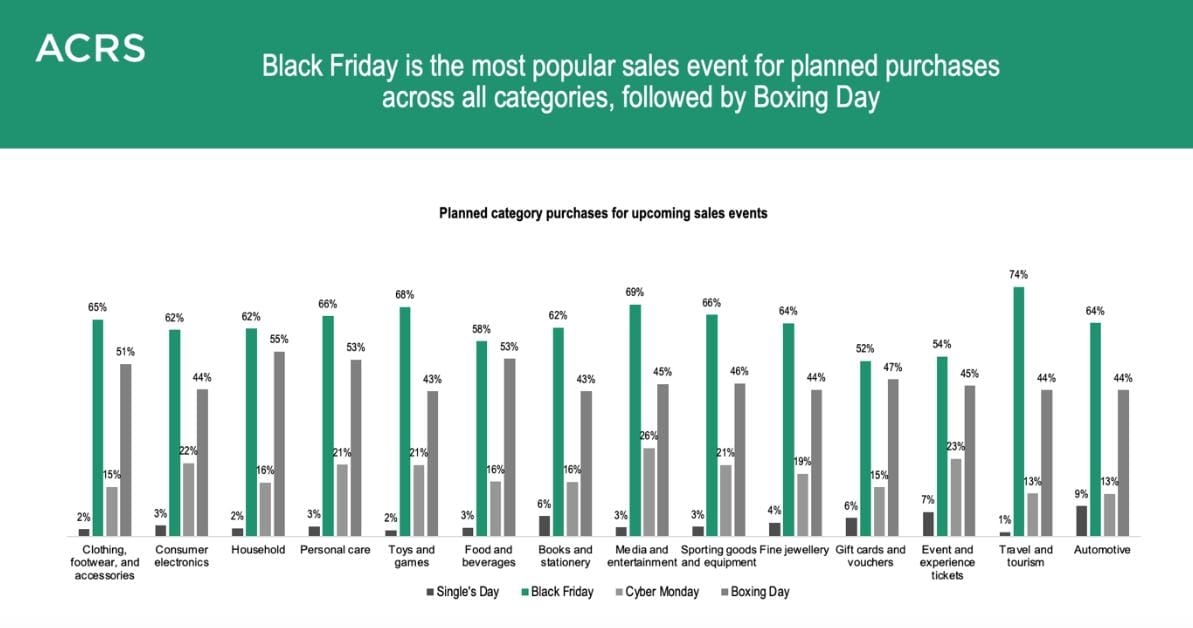

Additionally, 65% of shoppers planning to purchase clothing, footwear and accessories plan to do so on Black Friday (compared to 51% for Boxing Day); 62% of shoppers planning to purchase consumer electronics and household goods plan to do so on Black Friday (compared to 44% and 55%, respectively, for Boxing Day); and 66% of shoppers planning to purchase personal care items plan to do so on Black Friday (compared with 53% for Boxing Day).

Not only are more shoppers planning to shop during Black Friday compared to Boxing Day, they plan to spend more during Black Friday, too. Among sales events shoppers who set a budget, Black Friday budgets are $496 on average, while Boxing Day budgets are $402 on average.

Indeed, from the voices of customers, Black Friday is a common favourite for its perceived savings across a wide range of product categories and channels (online and in-store), authenticity of discounts, stock availability, and its convenient timing before Christmas.

As some shoppers said:

“Black Friday has great online deals, big discounts on tech and fashion, and it’s right before Christmas, so it’s perfect for gift shopping.”

“I enjoy Black Friday because there are usually big discounts on electronics and clothing, and it's easy to find good deals both online and in-store. The timing before the holiday season also makes it convenient for gift shopping.”

“Black Friday [is my favourite sales event], because this time is usually genuinely discounted and not just selling off rubbish, like Boxing Day.”

With sales already well underway, this week is set to be big, culminating in Black Friday and Cyber Monday. So, if you haven’t already done so, start writing a list of the things you want to purchase, set yourself a budget, research where you can purchase items, and set your notifications to grab yourself some bargains in time for Christmas.

Note about the research: Data was collected from n=1014 randomly-selected adult Australian shoppers in October 2025.