Bricks-and-mortar stores continue to play a pivotal role in the Australian retail landscape; however, the rise of online shopping cannot be understated.

In June, the Australian Bureau of Statistics (ABS) reported that online sales in June 2025 had increased by 13% through the year, while total retail turnover, including store and online sales, rose by 4.9% compared to last year.

These figures align with findings from Monash Business School’s Australian Consumer and Retail Studies (ACRS) annual ACRS Retail Monitor that monitors consumers’ shopping preferences and behaviour across Australia.

Results from our latest research show a growing preference for both physical and online shopping across most product categories, as physical and online stores close the gap on highly important purchasing factors such as customer service, payment methods, and delivery and return options.

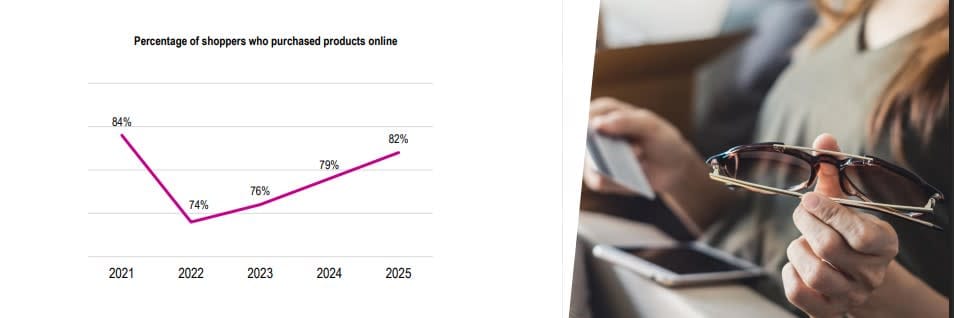

Online shopping returning to pandemic levels

At the peak of the pandemic in 2021, we recorded the highest participation of online shopping since tracking this metric, with 84% of Aussie shoppers having purchased products online in the past three months. As social restrictions eased in 2022, we saw this proportion dip to 74% as shoppers returned in-store. However, each following year this proportion has steadily increased and is now sitting at 82%.

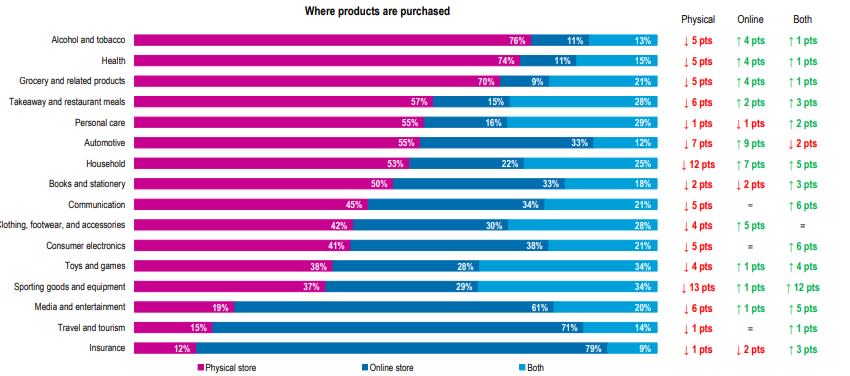

Notably, the proportion of Aussie shoppers who shopped at both physical and online stores in the past three months increased in all but two product categories, namely automotive (12%, down two percentage points year-on-year) and clothing, footwear, and accessories (28%, on par with last year).

Additionally, the proportion of Aussie shoppers who purchased exclusively online increased in nearly two-thirds of product categories.

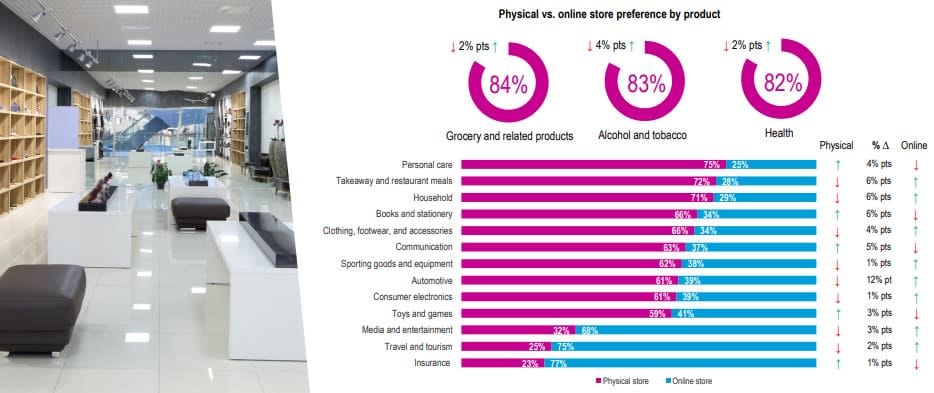

If they had to choose, Aussie shoppers preferred to purchase from physical stores across the majority of product categories. However, exclusive preference for online increased across two-thirds of product categories, including the top three brick-and-mortar favourites, namely grocery and related products, alcohol and tobacco, and health products.

Comparable physical and online store experiences

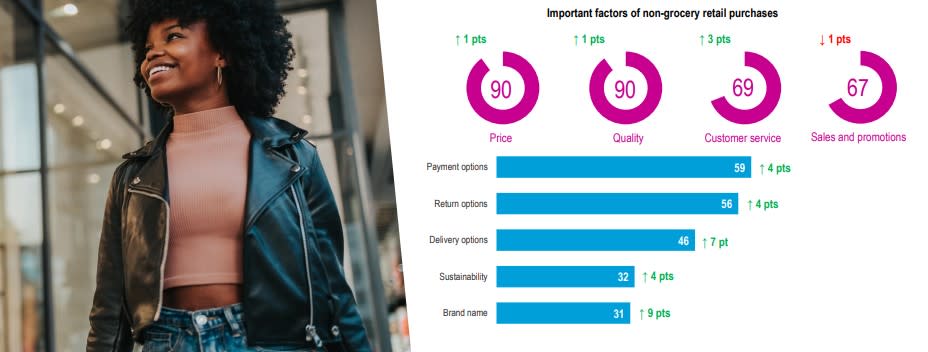

When asked to rate important factors influencing their purchase decisions, Aussie shoppers scored price and quality as the most important factors (both scoring 90 out of 100), followed by customer service (score of 69), sales and promotions (score of 67), payment options (score of 59), and return options (score of 56).

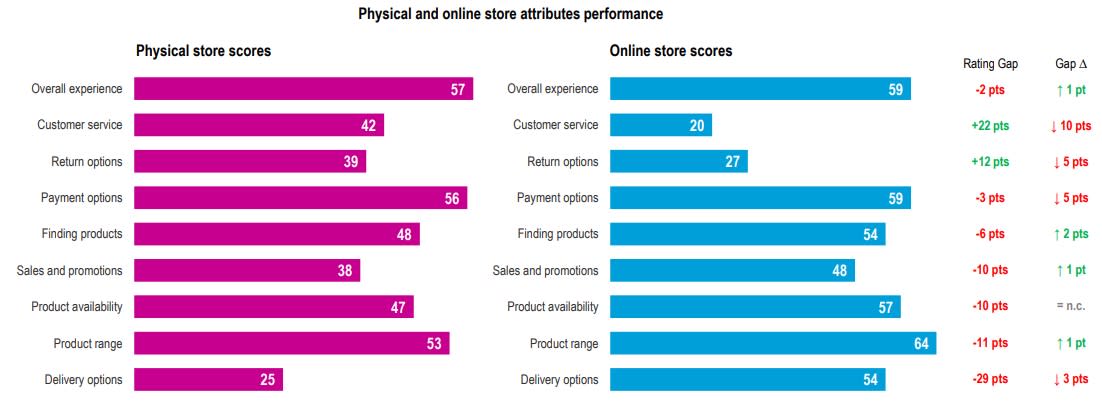

Historically, physical stores have scored higher than online stores on customer relationship factors such as like customer service (score of 42 v 20, respectively) and return options (score of 39 v 27), while online stores have scored higher than physical stores on pricing factors such as sales and promotions (score of 48 v 38, respectively) and payment options (score of 59 v 56).

However, this year we saw online stores starting to close the gap on customer service (gap score down by 10) and return options (gap score down by five), while physical stores closed the gap on payment options (gap score down by five) and remained competitive on sales and promotions (gap score up by one). This shows both channels have become more consistent on some of the most important factors influencing purchase decisions.

Indeed, online stores are only slightly ahead on overall customer experience with an index score of 59 out of 100, compared to the physical stores score of 57.

Integrating physical and digital

With the increasing proportion of Aussie shoppers using both physical and online stores, integrating both channels can future-proof retail businesses.

Legacy physical retailer David Jones launched its $65 million online app in late 2024 in a bid to create a seamless experience between its online and in-store transactions. David Jones heavily invested in technology behind the scenes so that its online and in-store processes provide relevant and up-to-date information, including pricing, availability, sizing and other detailed product information.

Whereas, online native THE ICONIC partnered with Hubbed in late 2024 to introduce a physical concept to allow Aussie shoppers to click, try and collect. The Martin Place metro station location in Sydney is a premium collection service for shoppers to pick up and try-on purchases in luxurious change rooms and provide on-the-spot returns, which reduces the onus on shoppers to drop returns at an appropriate location.

Retail partners are also upgrading to keep up with changing consumer demands. Australia Post has launched new stores in Melbourne and Sydney that have been designed to provide faster service, decrease congestion and better-manage increasing volumes of online shopping orders. The new locations feature digital self-service options, streamlined layouts, and improved parcel collection zones.

It’s positive to see Aussie retail discussions shifting away from in-store versus online and embracing Aussie shoppers’ changing preferences to shop physically and digitally.

Note about the research: The ACRS Retail Monitor investigates Australian consumers’ shopping preferences, attitudes and behaviour. Data was collected from n=1047 randomly selected Australian shoppers at the end of June 2025.