As the cost-of-living crisis continues to put pressure on Australian households, consumers are tightening their budgets, particularly in terms of their disposable incomes. Yet shoppers are still expecting to buy about the same amount of Christmas gifts this year, with some expecting to spend even more on their family and friends.

For the fourth consecutive year, Monash Business School’s Australian Consumer and Retail Studies (ACRS) conducted research to shed light on consumer retail trends this holiday season.

It found that, consistent with the past several years, the majority of Australian shoppers are intending to purchase Christmas gifts this year (88% in 2023; 90% in 2022; 92% in 2021), with some expecting to spend more on the people they’re gifting to this Christmas..

Sales events are kicking off the holiday season

With consumers feeling the crunch thanks to cost-of-living pressures, it’s no surprise that many are re-evaluating their budgets in anticipation of ongoing financial pressures, and targeting sales events this year.

Our research found Australian shoppers are more bargain-driven than ever before, with more and more planning to take advantage of the slew of sales events coming up in the final quarter of 2023, such as Black Friday, Cyber Monday, and Boxing Day, with 65% planning to make a purchase at an upcoming sales event (trending up from 61% in 2022 and 49% in 2021).

Unlike in previous years, our research found that this year Black Friday was the top sales event, with 39% of Australians expecting to make a purchase, up from 33% in 2022.

In contrast, slightly fewer were planning to purchase from the Boxing Day and Cyber Monday sales this year compared to last year, although Boxing Day remained high at 35% (slightly down from 37% in 2022).

Australian shoppers are also planning to spend the most money at Black Friday sales, expecting to spend an average of $434, followed by an average of $370 at Boxing Day sales, and $362 at Cyber Monday.

Spend is estimated to increase

This year, the majority of shoppers will be buying gifts for their immediate family (88%), while a third will be buying for extended family (30%) and friends (39%).

As expected, the average spend is much higher on presents within the immediate family group – Australians estimate they’ll spend $427 on Christmas presents for their immediate family (up 13% from 2022), compared with $246 for extended family (up 30% from 2022), and $149 for friends (up 12% from 2022).

While some of this increase may be attributed to inflation and supply chain price rises, our data indicates shoppers are also buying for more people, which may be a flow-on effect from the easing of COVID restrictions and the resurgence of large gatherings.

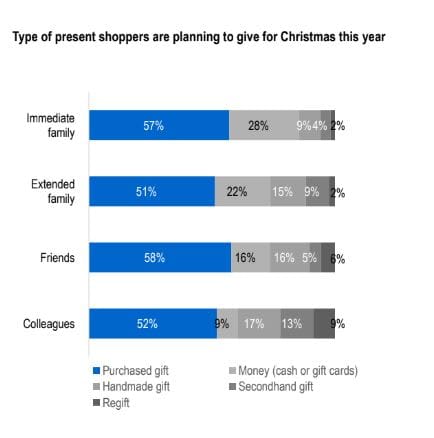

Research we conducted earlier this year found more than half of Australian shoppers (51%) say sustainability is an important factor when making a retail purchase, so this year we also asked them what types of presents they would give to others this Christmas.

While we found purchased gifts were the most popular type of gift, followed by money (in the form of cash or gift cards), some Australians will give handmade gifts to others – especially extended family, friends and colleagues.

When it comes to purchased gifts, clothing, footwear and accessories remains the most common type of product purchased for Christmas shopping this year, followed by gift cards and vouchers, food and beverages, toys and games, and books and stationery.

But Australian shoppers expect to spend more on their Christmas purchases across almost all categories this year. Compared with 2022, they expect to spend:

- 16% more on clothing, footwear and accessories

- 40% more on consumer electronics

- 16% more on household goods such as homewares

- 13% more on books and stationery.

How shoppers are buying

This holiday season, Australian consumers are planning to use a mix of physical and online stores to complete their shopping.

Physical stores remain the most popular way to shop for most products this Christmas, with four out of five shoppers (80%) planning to purchase a product in-store, similar to 2022 (82%). For example, 38% will buy clothing, footwear and accessory-related gifts at physical stores this Christmas season, while 27% will buy toys and games from a physical store.

But online shopping will also prove popular, with almost half of shoppers expecting to use physical retailer websites to purchase gifts this year (43%), and more shoppers expecting to buy gifts from online-only retailer websites than last year (44%, up from 37% in 2022).

While it’s certainly a trying time for consumers, the majority of Australian shoppers are still intending to purchase Christmas gifts this year, and in fact, by the time this article is published, many Australians would have started their Christmas shopping, with 54% starting one or more months in advance, and 46% starting in the four weeks leading up to Christmas.

Note about the research: Data was collected from n=1,014 randomly-selected Australian shoppers in October 2023.