News of Facebook working on blockchain first appeared around 8 May, 2019, when the company announced a major reshuffling of its top executives. It was quickly noted that David Marcus, then the head of Facebook Messenger and previously of PayPal, would head a blockchain group. Since then, there's been much interest, not only in the cryptocurrency world but also the traditional financial market.

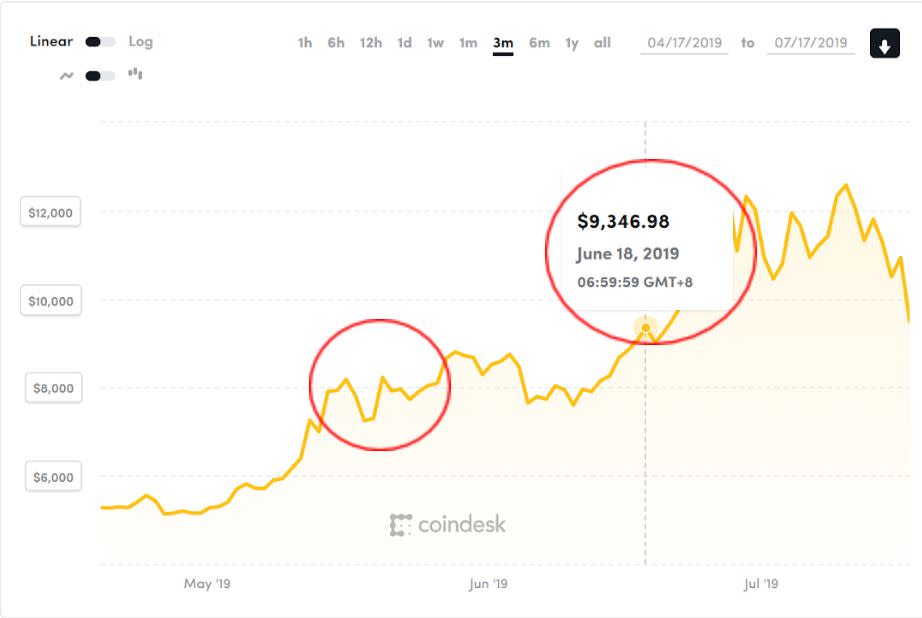

Then, on 18 June, Facebook revealed it was working on a cryptocurrency called Libra, together with a wallet named Calibra. It went on to announce that it was targeting a launch around mid-2020, with Calibra being available as a standalone wallet, as well as being part of WhatsApp (which is owned by Facebook) and Facebook Messenger.

This news seems to have had an implication on both the cryptocurrency market as well as the traditional currency (fiat) market.

Tracking the Bitcoin (BTC) price on CoinDesk saw an uptrend around those dates. Although the Libra cryptocurrency also uses the blockchain-distributed ledger technology, it's been designed to behave more like a traditional government-issued currency (fiat) than as a cryptocurrency.

Part of Libra’s intention is to address the shortcomings of using cryptocurrency as a regular, everyday currency.

Cryptocurrency a wild ride

One of the issues with using Bitcoin, or any of the other cryptocurrencies, is that its value fluctuates greatly over a short period of time.

Imagine if you're buying a car that was offered at BTC3.00 when the exchange rate between BTC and the USD is about US$10,854 to a BTC (16 July, 2019). While you're making the purchase, signing the sales and purchase agreement, and deciding on add-ons with your family, BTC saw a sudden overnight drop to US$9380 (this actually happened on 17 July this year).

To maintain the same USD value, the price of the car has to be BTC3.47. In only about 12 hours or less, the value of Bitcoin devalued by 15 per cent or more.

One may say that the transaction is in BTC and hence it shouldn't matter, but to the car manufacturer, many of its suppliers are paid in other currencies.

This is akin to great fluctuations in a regular government-backed currency, where payment in foreign currency makes businesses unsustainable if it fluctuates as wildly.

Some countries will peg their currency to a more stable one to ensure businesses operate as smoothly as possible. The Malaysian ringgit, for instance, was pegged to the US dollar in 1998 at MYR3.80 to a US dollar for about seven years.

Facebook Libra plans to achieve fungibility by pegging it against a basket of fiat currencies, and hence achieve stability in its value by treating Facebook Libra as a good asset that can be easily interchanged with major world currencies.

Cryptocurrencies transactions are too slow

A typical cryptocurrency such as Bitcoin or Ethereum is only able to achieve about 10 (usually less) transactions per second, compared to a Visa or Mastercard system that can achieve thousands of transactions per second.

This is due to the way the blockchain system is designed. Using Bitcoin as an example, it needs 51 per cent of all the servers that are validating the transaction to come to a consensus.

The process of validation is through something called mining – where mining servers need to solve a complex mathematical problem, what's also called the proof-of-work consensus.

As it's a decentralised system, there can be thousands, if not millions, of servers worldwide communicating with each other on every single transaction. Hence, it's a slow process.

Although there are other less resource-intensive consensus mechanisms such as proof-of-stake, proof-of-vote and so on, the main cryptocurrencies such as BitCoin, BitCoin Cash, Ethereum, Monero, Litecoin and Dash use proof-of-work, and, at best, they're achieving in the region of 100 transactions per second.

This isn't usable as a daily currency, as you can’t purchase an off-the-shelf item and make payment where you have to wait for minutes, if not hours, for the transaction to get approved. Imagine trying to purchase a cup of coffee and you have to wait for your transaction to be approved in 10 minutes or more.

Facebook intends to limit the number of servers to achieve the consensus through the membership of the Libra Association.

The Libra Association has 28 initial members, but this will likely grow. The members will not mine but will process the transactions using a private blockchain mechanism to validate the transactions.

This would mean that it's a more environmentally-friendly solution. However, limiting it to members of the Libra Association would mean that it's not a truly decentralised solution, and the Libra Association thus plays a similar role to a central authority. Not being truly decentralised contravenes the creation and benefit of a true cryptocurrency.

Limited in circulation

The Bitcoin cryptocurrency has a maximum number that can be created – it's just slightly shy of 21 million BTCs.

The issue is not only with the limited number that can be circulated, but also with the issue of lost Bitcoins (similar to lost physical coins and notes). The respective sovereign monetary authority such as the federal reserves will be able to estimate the need to mint new money due to the retiring of old, soiled notes or simply the need to increase the circulation.

In Bitcoin, this is not possible, but there are existing proposals, such as Ethereum’s “Token Standard Extension for Increasing and Decreasing Supply” (ERC-621) to achieve this.

Facebook Libra isn't limited, but is minted when an equivalent fiat currency enters into the system or the equivalent Libra is destroyed when it's withdrawn as a fiat currency. This ensures it can grow and keep the stability of the Libra value. This is called the Libra Reserves. Similar to the fiat being backed by Gold Reserves, the Libra is backed by the Libra Reserves, which is based on the amount of fiat currency coming into the system.

Over a long period of time, with small fluctuations of the fiat currencies, the Libra Reserve is unlikely to reflect the exact amount of Libra in circulation. But this should reach an acceptable equilibrium.

Facebook Libra plans to be a world monetary authority (or central bank) through the Libra Association using a private blockchain system.

Facebook Libra plans to be a world monetary authority (or central bank) through the Libra Association using a private blockchain system.

It understands that access to financial transaction data is a very powerful tool, and only allowing members of the Libra Association to have access to the data can be beneficial for the members. It's also a possible avenue for the millions of unbanked population worldwide to access financial instruments in the future.

The process of convincing and obtaining the necessary approvals has started and is being scrutinised. We'll have to wait for the next few months, if not years, for Libra to materialise.

For more information on programs offered at the School of Information Technology, Monash University Malaysia, please visit here.

This article was co-written with Reza Ismail, CEO of Syscode Sdn Bhd.