Since US President Donald Trump tweeted about imposing new tariffs on China, global equity markets have gone into a tailspin.

Trump’s more recent announcement that the new tariffs would be delayed hasn't calmed the markets, with recent days seeing very large falls in most major stockmarkets.

Another factor particularly spooking the markets in recent days has been the “inversion of the yield curve” in the United States.

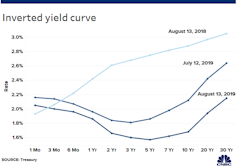

The yield curve is a graph showing the relationship between interest rates earned on lending money for different durations.

Normally, someone who lent to the government or a corporation for one year (by buying a one-year government or corporate bond) would expect to get a lower interest rate than someone who lent for five or 10 years, making the yield curve upward-sloping.

An inverted curve slopes down

A simple way to get an idea of the slope of the yield curve is to compare a short-duration government interest rate for a two- or three-year government bond with the rate on a 10-year government bond.

In Australia, the 10-year government bond rate has just fallen to a record low 0.891 per cent, only slightly above the three-year rate at around 0.7 per cent.

In the US in recent days, the 10-year bond rate has fallen to the point at which the 10-year rate is below the two-year rate – so the yield curve is inverted.

What's made the markets so nervous is that there's been a yield curve inversion before each of the past seven recessions.

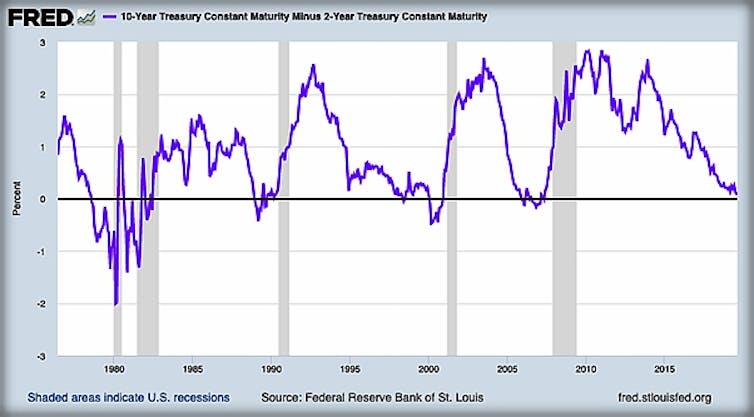

The graph pictured right plots the difference between the US 10-year government bond rate and the US two-year government bond right back to the 1970s.

When the difference is negative (when the 10-year bond rate slips below the two-year bond rate), the line moves below zero.

It's done it just before each of the US recessions, which are also marked.

Sometimes the recession follows soon after the line slips below zero, and sometimes there's a delay. Interestingly, in the case of the most recent recession, the yield curve inversion was quite small, and began some time before the global financial crisis.

So does correlation imply causation? Reserve Bank Deputy Governor Guy Debelle said on Thursday that this time is different.

We should certainly hope so.

There are good reasons to think that this time it will be different.

No recession this time?

One reason is that although central bank-controlled rates are near record lows, most central banks have also announced words to the effect of “doing what it takes” to support the economy. With the markets expecting further rate cuts, long-term rates might simply reflect this rather than expectations of a recession.

Of course, it could be that markets see central banks’ cuts as a sign that they see a recession coming. It’s hard to tell.

Another reason to think it might be different this time is that President Trump pressured the Federal Reserve to cut rates. Many economists think the latest rate cut took place for that reason rather than because of economic fundamentals.

The simple point here is that a lot of things are different this time.

Many economists, such as myself, view recent moves by central banks to cut rates as unproductive.

Read more: Vital signs: Amid talk of recessions, our progress on wages and unemployment is almost non-existent

The gist of these arguments is that the Australian economy has reasonably strong fundamentals, and any weakness can be better dealt with by measures other than rate cuts. Among them would be measures to boost productivity.

In the US, by contrast, there are indeed reasons to be concerned about a recession.

The trade war with China has already been very destructive, and the political uncertainty of Trump, high debt levels and other structural weaknesses are creating problems.

A US-only recession?

The last time the US entered recession was September 2008. During that quarter global trade fell off a cliff, but in the year that followed Australia’s economy grew by a solid 4 per cent.

Supporting Australia’s economy was a very large Chinese stimulus package that led to very strong demand for Australian resources.

A recession in the US in the next year or two would again lead China to consider all options. Traditionally, those options have included much more funding for resource-intensive infrastructure.

While that's the most likely path China would take, it probably has less financial room to supercharge infrastructure than in 2008. That’s enough of a reason for Australians to be very concerned if the US goes into recession.

In the end, though, it's worth remembering that Australia’s economy is still in a reasonably strong position compared to others. Unemployment is low, wages growth is higher than it was at 3.1 per cent, public debt is low, and other fundamentals are reasonably sound.

Read more: Their biggest challenge? Avoiding a recession

But predicting recessions is notoriously difficult.

There are some who have nine times predicted a recession in Australia, yet only twice have those predictions been proven. Those pundits are very pessimistic now!

I tend to be more of the view that the probability of a recession in Australia in the next year or so is higher than it has been since 2008, but a recession is far from the sure thing that yield curve readers might suggest.

Read more: Buckle up. 2019-20 survey finds the economy weak and heading down, and that's ahead of surprises

This article originally appeared on The Conversation.