Indonesian President Joko Widodo’s administration recently announced that Indonesia’s carbon market is open for international investors.

Last year, projects that issued new carbon credits were stopped on the grounds that verification processes didn’t follow Indonesian law. But now, new carbon market projects will be permitted, provided they adhere to national regulations, which are still in development.

Indonesia prepares to enter the carbon markethttps://t.co/jkyo9yeJsr

In black sneakers, black pants, and a white long-sleeved shirt with rolled-up sleeves, President Joko Widodo stepped into a "swamp" at Angke Kapuk Nature Park in Jakarta on Monday to plant a mangrove tree. pic.twitter.com/24Rpkvi7bX— Worldview International Foundation (@WorldviewInter1) May 17, 2023

The announcement brings with it assurances for international investors that the world’s third-largest tropical rainforest nation will be a source of verifiable carbon credits.

At COP27, Indonesia, together with Brazil and Democratic Republic of Congo, announced an alliance of tropical rainforest nations, dubbed the “OPEC of the rainforests”.

According to the report issued by the oil company Shell, the size of global voluntary carbon markets are expected to increase at least five-fold by 2030. Indonesia’s Ministry of Environment and Forestry estimated that the country’s economic potential for carbon trading stands at about IDR$350 trillion (US$25 billion) between 2022–2026.

The recent announcement sends a positive signal that the country is open for an international carbon market, but there are many details that need to be addressed.

The country has appointed the Financial Services Authority (Otoritas Jasa Keuangan) to oversee the country’s carbon trading platform. The OJK’s existing mandates focus on regulating and overseeing the financial services industries.

As carbon finance is a relatively new financial instrument, or even commodity to trade, it remains unclear if the OJK has the capability to oversee the trades.

To boost the confidence of new international investors, OJK could collaborate with experts on carbon trading to show investors a steep learning curve, rigorous carbon standards, and high-integrity standard operating procedures.

The carbon market’s integrity is a crucial element to address. In its regulations, Indonesia had already mentioned “mutual recognition” for international carbon standards – for example, Verra, Gold Standards, and American Carbon Registry.

Yet, it’s important that the Indonesian registry system, Sistem Registri Nasional (SRN), can verify carbon projects to a high, internationally acceptable standard. Investors will need to see more examples of internationally verified projects also being validated by the SRN, similar to the Verra-verified Rimba Raya project.

Further, a high-integrity carbon market in Indonesia will require strong bilateral and multilateral agreement regarding carbon credit ownership, which normally will refer to the Paris Agreement Article 6.

Indonesia needs a clear plan on how it will regulate voluntary carbon markets, particularly how its SRN will work to improve the integrity of its carbon market architecture.

How Indonesia classifies carbon projects is also important. Indonesia has made it clear it will move to regulate all carbon projects, though the government has said that some exceptional projects such as Just Transition projects, renewable energy, green industry, and forest-based energy projects would be exempt.

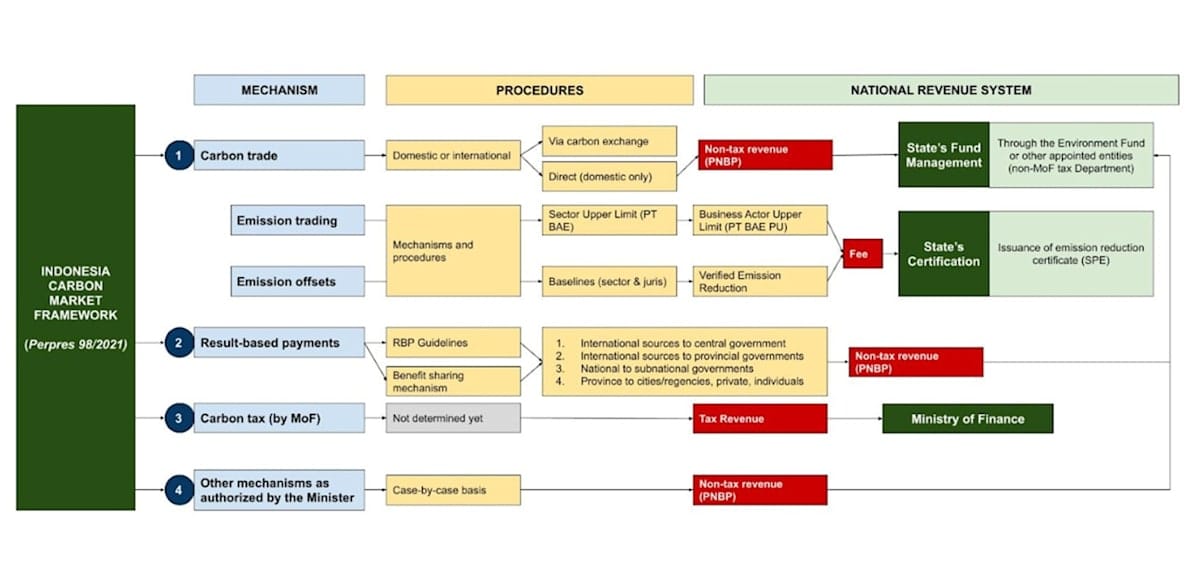

The Indonesia carbon market regulatory framework based on Presidential Regulation does not recognise the term “voluntary carbon markets”. Source: Author

The country will need to determine how it treats such exceptions for “strategic” and “pioneering” carbon projects in the future.

In this regard, it’s important for the Indonesian government to clarify the criteria on what kind of projects will fall into these categories, to exhibit transparency and integrity of the carbon market it’s trying to establish.

Carbon markets, more broadly, are subject to debate and distrust due to double counting or lax standards.

Questions regarding the credibility of voluntary carbon credits are already pervasive. How Indonesia navigates these issues and ensures its national carbon market system produces high-quality emission reductions will be a challenge in the market’s nascent stages.

Effective governance, efficient tracking mechanism, transparency procedures, and robust third-party verification all can help ensure the market has integrity and international credibility.

We recommend Indonesia focus on ensuring its carbon market achieves a high level of integrity. This is not just to boost the confidence of market participants such as credit buyers, project developers and investors.

Sharing the benefits

In an ideal carbon market, the market would present adequate benefit-sharing to civic society organisations and community groups – who act as guardians of the land where carbon projects take place – with carbon finance.

A high-integrity carbon market ensures these groups are actively involved and not marginalised by any carbon project, and the appropriate amount of finance will consistently flow into these groups to assist them conserve their lands for years to come.

Climateworks’ Indonesia Voluntary Carbon Market (VCM) Integrity project aims to help increase the integrity of voluntary carbon projects in the nation.

This project seeks to identify the critical mechanisms that promote wider understanding of the need for environmental and social integrity across voluntary carbon projects.

It will also provide pointers for decision-makers to understand how voluntary carbon projects can contribute to the national climate contributions and Paris Agreement temperature goals, and allow them to incentivise high-integrity voluntary carbon projects in Indonesia.