The Albanese government’s 20% cut to student debt is the first bill introduced to the new federal parliament. It’s clever politics.

In the government’s first term, the three million Australians with a student debt turned high indexation of their loan balances into a major issue. The proposed 20% cut flipped a political negative into a positive ahead of the May 2025 federal election.

The 20% cut legislation, introduced on Wednesday, will also change how student debt is repaid. All the 1.2 million people currently repaying student loans will pay less per year as a result.

How does the cut work, and what does it mean in practice for current students and people with student debt?

Beware the fine print

These changes come with disadvantages. The 20% cut is not well-targeted. It will deliver major benefits to recent graduates, but much less to current students or earlier graduates, and nothing to future students.

While repaying less HELP debt per year sounds good, more graduates will be caught on a debt treadmill, repaying less than the annual indexation on their HELP balance. Both HELP changes will also be costly for government.

Meanwhile, the government hasn’t changed the cost of degree courses. Arts, law and business students continue to accrue debts of about $17,000 per year of study.

How does the cut work?

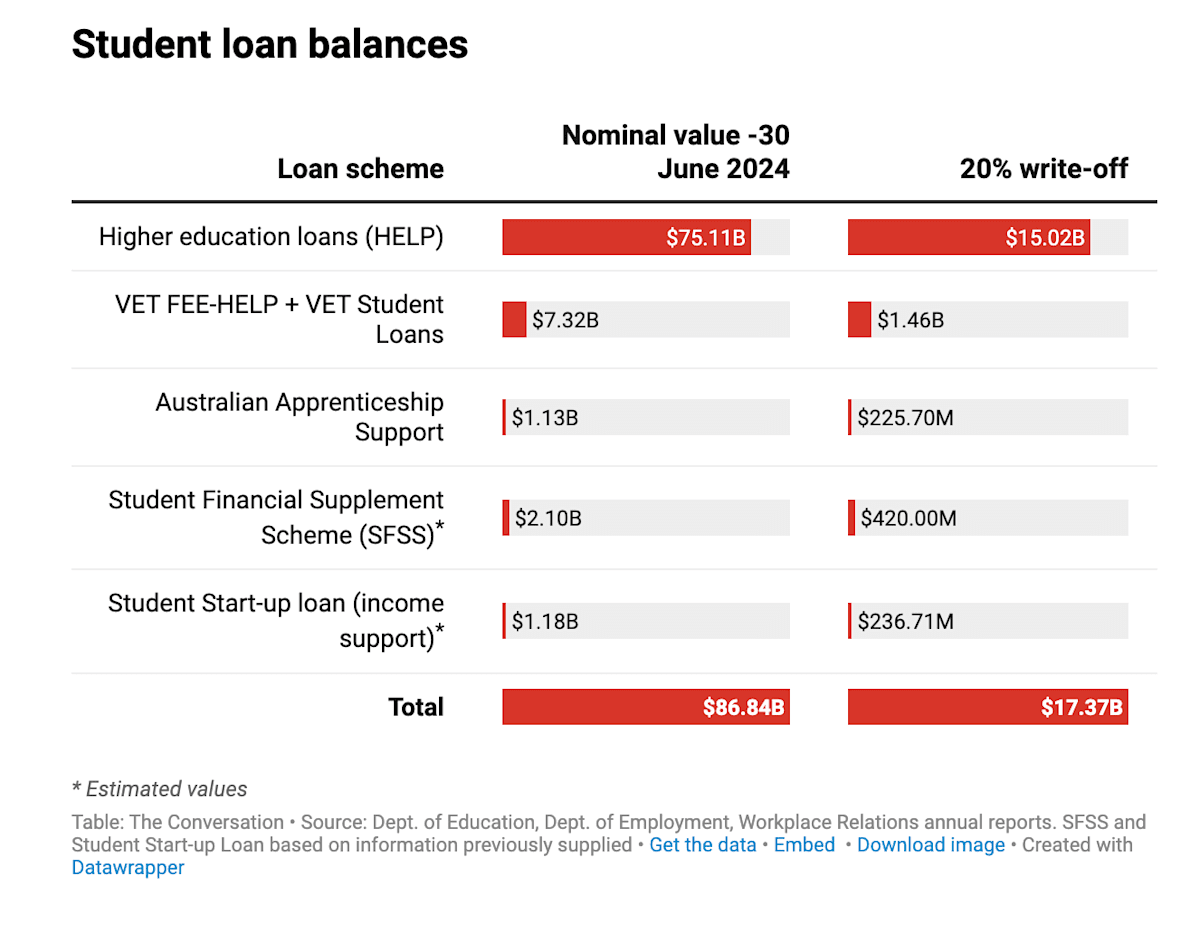

The 20% cut applies to all student loan schemes, including the five HELPs now operating in higher education – HECS-HELP, FEE-HELP, OS-HELP, SA-HELP and START-UP HELP. These cover student fees as well as other programs to assist with overseas study or amenities fees.

The loans to be cut by 20% will be based on amounts owed as at 1 June, 2025. As a guide to the amounts of money involved, the table below shows balances as at 30 June, 2024.

Why the cut is not fair

The benefits of the 20% cut will be distributed in a random and inequitable way, as a recent analysis from economic think tank the e61 Institute shows.

The biggest beneficiaries will be people who recently gained their degrees – their borrowing has peaked, but they have not made any significant repayments. Graduates who are partway through clearing their debt, and current students, will receive some benefit. People who recently completed their repayments, and future students, will receive no benefit at all.

Other winners from the 20% cut will be current and former students of private higher education institutions, as they pay relatively high fees via the FEE-HELP scheme. So too do people who have borrowed to finance postgraduate degree courses. Although most student debtors are women, men on average have higher debts, so they will benefit more from the 20% cut.

A new repayment scheme

The government is also changing how student debt is repaid.

The income threshold at which repayments start will increase from A$56,156 to $67,000 a year for 2025-26. People with incomes between these levels who currently repay via employer salary deductions can stop after the legislation comes into force. Any unnecessary repayments will be refunded when 2025-26 tax returns are processed.

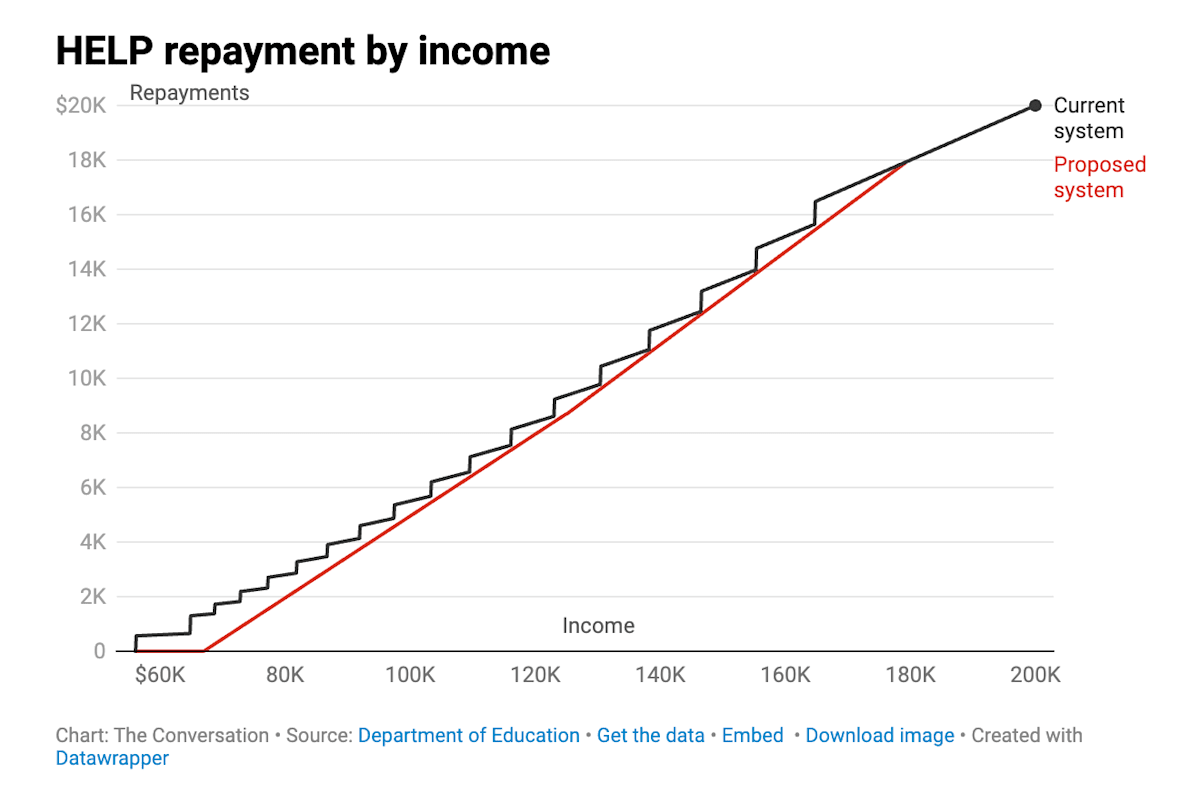

Once the first income threshold is passed, the way repayments are calculated will also change. Under the current system, the repayment is a percentage of the person’s total income. At the $56,156 threshold the repayment rate is 1%, leading to a repayment of $561.56.

These percentages increase incrementally up to 10% on incomes of $164,712 or more. The jagged repayment amounts in the chart below are the percentage of income rates changing 18 times on their way to 10%.

The current repayment system was criticised as “unfair” by the Universities Accord final report in 2024, as an increase in income can result in lower take-home pay.

Under the proposed system, nobody will take home less money after a pay rise. Repayment will be based only on marginal income – the amount above the threshold. People with student debt will pay 15 cents in the dollar for all they earn between $67,000 and $124,999. From $125,000 the rate lifts to 17 cents in the dollar.

The government has capped annual repayments at no more than 10% of the person’s total income. This ensures nobody pays more under the new repayment system.

Slower repayments mean more debt in the end

But there’s a catch.

A Parliamentary Budget Office costing released in April 2025 estimates the effects of the new system on HELP repayment times. Obviously, if people repay less each year it will take them longer to clear their debt.

For a HELP debtor consistently earning an average graduate income, the budget office estimates full repayment would take one more year, to 11 years in total. But for people starting their careers on lower incomes, below the $67,000 first threshold, repayment times could increase by much more, dragging out full repayment time from 32 to 40 years.

What happens early in graduate careers is a major concern with the new system.

Consider an arts graduate who gains their degree with a HELP debt of $50,000. Indexation at the current inflation rate of 2.4% would be $1200. Under the current repayment system, an arts graduate earning $65,000 would cover their indexation and reduce their debt by $100. Under the proposed system, arts graduates will see their debt increase through indexation unless they earn at least $75,000. For context, the median full-time salary for an arts graduate in 2023 was $69,400.

The worry is many people will get stuck on a HELP debt treadmill, seeing their debt increase each year as they repay nothing or less than the indexation amount.

The cost of these reforms

In another report, the Parliamentary Budget Office estimated the initial debt waiver will cost $9 billion, plus the loss of future indexation.

But quantifying the total cost of these changes is not straightforward, as it involves estimating the future income and consequent HELP repayments of three million people.

As most HELP debtors will repay less each year under the new system, for the government it means delayed repayments and higher bad debt. The budget office thinks in 2025-26, repayments of loan principal will decline by $820 million compared to the current system.

What about the Job-ready Graduates scheme?

This highlights the need for a more coherent funding approach that integrates debts and repayments in ways that are fair to students while moderating the cost to government.

The Universities Accord final report recommended student contributions should be realigned with graduate earnings.

Ideally, graduates working full-time should complete repayments within similar ranges of years, regardless of which course they took. That is far from what happens under the current system – known as the Job-ready Graduates scheme – set up under the Morrison government. With the annual humanities student contribution for 2026 set at $17,399, many arts graduates will struggle to ever get their debt under control.

The government has promised but postponed changes to student contribution levels. The new Australian Tertiary Education Commission will advise the government on this matter.

But student contributions alone cannot fix the problem. The repayment system must also be realistic about what different types of debtors earn. Especially with student loans now also serving vocational education, the $67,000 first threshold risks creating a larger group of people with permanent student debt.

This article originally appeared on The Conversation.