Christmas retail seems to begin earlier each year, and 2024 is no exception.

This is in part due to the ever-expanding Australian retail sales calendar, particularly events that have sprung up in November in the past two decades.

Traditionally a month void of sales, November is now the busiest month in the calendar due to the adoption of popular international events (such as Black Friday and Singles Day), counterculture movements (such as Green Friday and Colour Friday), and dedicated eCommerce sales (such as Cyber Monday and Click Frenzy The Main Event).

With cost-of-living pressures and elevated inflation an ongoing concern for Aussies, these sales events offer a welcome reprieve and an opportunity to snatch a bargain in time for Christmas.

Monash Business School’s Australian Consumer and Retail Studies (ACRS) annual seasonal retail research shows that almost two-thirds (62%) of Australian shoppers plan to make a purchase at end-of-year sales events across November and December.

Black Friday is the new Boxing Day

Black Friday has been gaining traction in recent years and is now Australia’s top sales event, surpassing Boxing Day. This year, 41% of shoppers are planning to make a purchase during the Black Friday and Cyber Monday weekend sales event, with plans to spend $481 on average, compared to 37% of shoppers planning to make a purchase during Boxing Day sales, with plans to spend $367 on average.

Black Friday is a favourite among savvy Aussie shoppers who are eager to seize superior deals and start their Christmas shopping early.

Fashion retailers are expected to benefit most, with 64% of sales-event shoppers planning to purchase clothing, footwear, and accessories at an upcoming sales event, followed by almost a third of shoppers who plan to buy consumer electronics (35%), household goods (31%), and personal care items (28%).

Aussie shoppers intend to use a variety of payment methods when it comes to making sales purchases. Debit card is the most popular payment method, with 63% of shoppers intending to use debit cards, followed by credit card (47%), Buy Now, Pay Later (30%), and cash (25%).

Christmas cheer for those near and dear

It seems Aussies are starting to feel the Christmas spirit, with consumer sentiment rising. The Westpac-Melbourne Institute Consumer Sentiment Index rose 5.3% to 94.6 in November, up from 89.8 in October. This is also reflected in our latest research, which shows the majority of Australians (91%) are planning to buy Christmas gifts and related products this year.

The main beneficiaries of Christmas gift-giving this year are our nearest and dearest. Christmas shoppers plan to buy the most for immediate family (89%), extended family (28%), and friends (35%).

Further, average spend is highest for immediate family ($474), extended family ($277), and friends ($175), and is expected to increase year-on-year for these loved ones (up 11%, 13% and 17%, respectively).

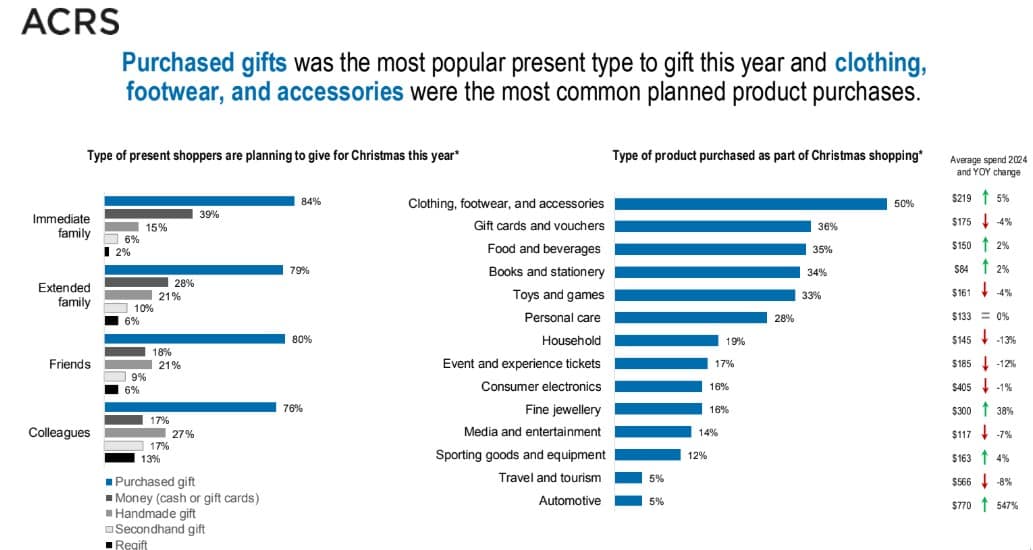

Purchased gifts are by far the most popular present type shoppers are planning to give this year (above 75% across all gift-receiver groups). Money (cash or gift cards) is also a popular choice for immediate family (39%) and extended family (28%), while handmade gifts are a favoured gift option for colleagues (27%), friends, and extended family (both 21%).

Half of Aussie shoppers (50%) expect to purchase clothing, footwear, and accessories as part of their Christmas shopping. Other popular products purchased for Christmas this year include gift cards and vouchers (36%), food and beverages (35%), books and stationery (34%), toys and games (33%), and personal care items (28%).

Aussies head to the shops this Christmas

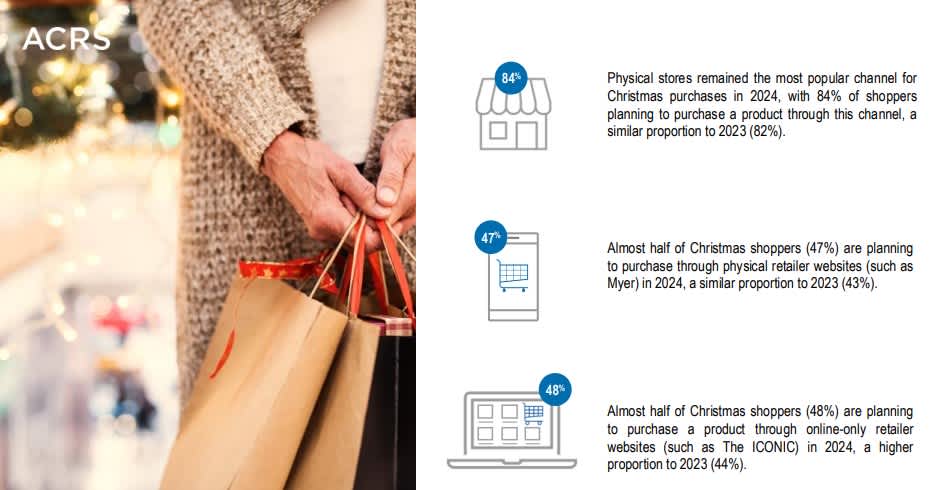

Physical stores remain the most popular channel for Christmas purchases in 2024, with 84% of Australian shoppers planning to visit stores to do their Christmas shopping. This is true across most product categories, especially for all the aforementioned popular Christmas gift categories, with 68% or more shoppers planning to make these purchases at bricks-and-mortar stores.

Online shopping remains a popular channel among shoppers this year, with 47% of Christmas shoppers planning to purchase through physical retailer websites (such as Myer), and 48% planning to make a Christmas purchase through online-only retailer websites (such as The ICONIC).

While physical store purchases are preferred across most categories, online channels are popular for event and experience tickets, consumer electronics, and travel and tourism purchases this Christmas.

This weekend is set to be a big one, kicking things off with Black/Green/Colour Friday and culminating with Cyber Monday. So, if you haven’t already started, begin writing your Christmas list and get shopping to nab yourself – and maybe your loved ones – a bargain.

Note about the research: Data was collected from n=1,012 randomly-selected Australian shoppers in October 2024.